Learn How To Escape the 9-5 Grind

Our Mission

Helping you build holistic generational wealth so you can create a lifestyle you love and

Live Your Best Life the Rest of Life

Hi there! It’s me.

I’m Amber.

I’m a Fortune 50/100/500 FINANCE GURU that left corporate America to help people like you create systems to build generational wealth through goal setting, budgeting, and changing your mindset about wealth and money.

I’m a purpose-driven wife/mother/daughter who was sick and tired of being sick and tired. Of trading my precious time for money, only for my time commitment to pad corporate pockets and take me away from my family.

I was stressed, burnt out, and running out of time every day. Does this sound like you? My body was frankly shutting down. My hip flexors were so tight from sitting over 60 hours a week that when I would get up to walk, I was in excruciating pain, limping, and couldn’t even stand upright for a solid minute. While showering one day (no knocks, anyone else do their most profound problem solving in the shower?!) I realized I loved the financial aspects of my job AND I loved the people interaction and people development. But I did not love the corporate rat race.

So here we are. I want to spend more precious time with my family and in the process help you build generational wealth and create more financial freedom.

Does this sound like you too? Keep reading.

I genuinely love helping people become the BEST version of themselves and wanted to combine my FP&A (Financial Planning & Analysis) knowledge and love of people to help YOU grow and create a lifestyle you love and

Live Your Best Life the Rest of Life

So how could I leave a successful corporate America career before retirement age?

By Changing My Mindset About Wealth and Using Simple to Implement Goal Setting Techniques

So I did it. I left.

For the past several years we as a family have been on a journey of holistic WEALTH. Wealth is genuinely more than just money. Money is an output or compilation of many actions we take.

Looking back (and getting really personal), when my now husband and I first met, we had a combined 5-figure Net Worth.

For those without a finance background, Net Worth is simply your assets (cash, investments, real property, etc) less your liabilities (mortgage, auto loan, education debt, credit card debt, etc).

In just under 8 years, we have grown our Net Worth over 20X (multi 7-figure) simply by being mindful about our wealth and taking a holistic approach to building wealth because true wealth isn’t just about your job or your money. Yes, that figure above is $$ and yes, we did tackle our spending and investments because money pays the bills. BUT true wealth isn’t a “get rich quick” scheme. In most cases those don’t exist. True wealth is about sustainable lifestyle change so you can

Live Your Best Life the Rest of Life

So what is WEALTH?

Wealth is plentiful supply, well-being, or prosperity

Let’s review the 6 Types of Wealth and start to identify where you have plenty and where you are lacking.

The 6 Types of Wealth

Physical Wealth

Health and vitality are invaluable assets that contribute to one's overall well-being and quality of life. Investing in physical fitness, nutritious food, and self-care practices lays the foundation for a rich and vibrant existence.

Emotional Wealth

Mental and emotional well-being are priceless treasures that can't be bought with money. Cultivating resilience, nurturing relationships, and finding fulfillment in meaningful pursuits are essential aspects of emotional wealth.

Intellectual Wealth

Continuous learning and personal growth enrich the mind and expand horizons. Investing in education, acquiring new skills, and fostering curiosity are pathways to intellectual wealth and lifelong fulfillment.

Social Wealth

The strength of one's social connections and support networks is a fundamental measure of wealth. Building authentic relationships, contributing to communities, and fostering a sense of belonging are hallmarks of social wealth.

Spiritual Wealth

Inner peace, purpose and a sense of connection to something greater than oneself form the bedrock of spiritual wealth. Cultivating mindfulness, practicing gratitude, and aligning with one's values are pathways to spiritual fulfillment.

Financial Wealth

Cultivating a mindset of abundance, stewarding resources wisely, and living a life of purpose and fulfillment. Creating spending and saving habits that facilitate a joyful lifestyle.

Great! You know the 6 areas of WEALTH.

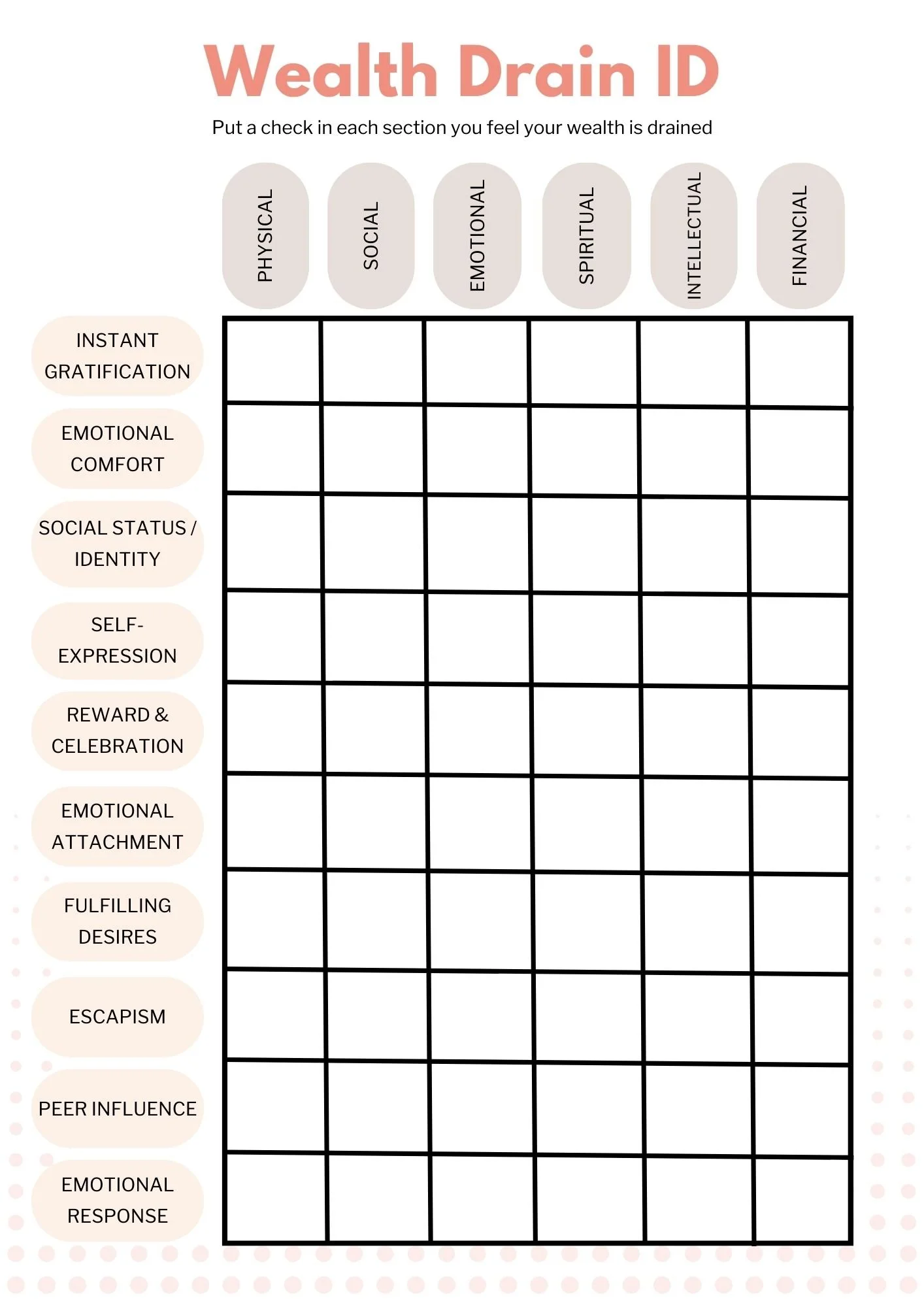

Now let’s talk about how we rob ourselves of WEALTH and how to fix it.

START HERE: Understanding WHY you consume

Spending or depletion of WEALTH is often driven by a combination of rational and emotional factors. While rational reasons for spending money may include fulfilling basic needs or making practical purchases, emotional reasons can be more complex and varied. Here are some emotional reasons for spending money:

Instant Gratification: Many people derive pleasure from purchasing and immediately owning a desired item. The anticipation and excitement of acquiring something new can temporarily boost mood and satisfaction.

Emotional Comfort: Shopping or spending money can be a form of emotional comfort or stress relief. Retail therapy is a common phenomenon in which individuals turn to shopping to cope with negative emotions such as sadness, anxiety, or boredom.

Social Status and Identity: Purchases can be motivated by a desire to project a particular image or social status. Buying luxury goods or branded items may be driven by a desire to signal affluence, sophistication, or belonging to a specific social group.

Self-Expression: Our personal styles and tastes are expressed through the items we purchase. Buying clothing, accessories, or home decor that aligns with our aesthetic preferences can be a way of expressing our individuality and identity.

Reward and Celebration: Spending money on special occasions or treats can be a way of rewarding oneself for accomplishments or milestones. Whether it's treating oneself to a nice meal, a spa day, or a vacation, these purchases serve as a form of self-celebration and acknowledgment of achievements.

Emotional Attachment: Some purchases are driven by emotional attachment or sentimental value. People may spend money on items that hold nostalgic significance or remind them of special memories, loved ones, or experiences.

Fulfilling Desires and Aspirations: Purchases may be motivated by a desire to fulfill long-held dreams or aspirations. Whether buying a dream home, traveling to exotic destinations, or pursuing hobbies and passions, spending money can turn aspirations into reality.

Escapism: In some cases, spending money on experiences or entertainment can provide a temporary escape from reality. Whether it's going to concerts, movies, or traveling, these purchases offer a break from the routine and mundane aspects of daily life.

Peer Influence: Social pressure and influence from friends, family, or social media can also influence spending behavior. People may feel compelled to keep up with others or participate in certain activities or lifestyles, leading to purchases influenced by external expectations.

Emotional Response to Marketing: Marketers often use emotional appeals in advertising to evoke specific feelings or desires that drive purchasing behavior. Emotional triggers such as nostalgia, fear of missing out (FOMO), or the desire for happiness and fulfillment can influence consumer decisions.

It's important to recognize that while emotional spending can provide temporary satisfaction, it's essential to maintain a healthy balance and ensure that spending aligns with long-term financial goals and values. Mindfulness and self-awareness can help individuals make more conscious and intentional spending decisions.

Here’s your FREE Wealth ID toolkit to help identify your areas of wealth drain.

Want to begin your journey to greater wealth? Sign in below for FREE

This is NOT a get rich quick scheme. This is mindful total wealth coaching to help you achieve your goals sustainably and live life to the fullest!